Figuring out government programs can feel like trying to solve a puzzle! One question people often have is, “If I get Medicaid, do I also get food stamps?” Medicaid helps with healthcare costs, while food stamps (officially called SNAP, or Supplemental Nutrition Assistance Program) helps pay for groceries. They are both helpful programs, but they work a little differently. Let’s break down what you need to know about these two programs and if getting one means you automatically get the other.

Does Having Medicaid Automatically Mean I Get SNAP?

No, having Medicaid does not automatically mean you qualify for SNAP. Think of it like this: Medicaid helps pay for your doctor visits and medicine, while SNAP helps you buy food. They are separate programs with their own rules and requirements.

Income Requirements for SNAP

One of the biggest things SNAP looks at is your income. Each state has its own specific income limits, and these limits change depending on the size of your household. Generally, if your income is below a certain level, you might be eligible. SNAP considers various sources of income, including wages from a job, unemployment benefits, and Social Security. The income limit is based on the federal poverty level, but the exact cut-off varies based on your state.

To find out if you qualify, you will need to apply. The application process usually involves providing information about your income, resources, and living situation. You can typically apply online, by mail, or in person at your local SNAP office. Make sure you have the right documents ready. This often includes things like pay stubs, bank statements, and proof of residency.

Here’s a basic idea of what income level you may need to meet, but remember, it changes. It is best to look up your state’s specific guidelines for accuracy.

- The income requirements are different for each state.

- Household size is important. A larger household usually means a higher income limit.

- The government updates the limits regularly.

Here’s an example, but these numbers change regularly, so do your research. If you are a single person, you must have a gross monthly income below about $1,500. If you are a family of four, you must have a gross monthly income below about $3,000. Again, this is just an example, and it’s crucial to check the official SNAP website or your local department of social services for the most up-to-date information.

Asset Limits and SNAP Eligibility

Besides income, SNAP also looks at your assets, like savings and investments. There are limits on how much money and other resources you can have to be eligible for SNAP. These asset limits are also set by each state, but they are generally designed to make sure the program is focused on people who truly need help. The exact limits can vary, so check your state’s SNAP guidelines.

Here is a simple breakdown:

- Most states have an asset limit of around $2,750 for households with an elderly or disabled member.

- For other households, the limit is often around $2,500.

- Specific assets like your home and car are often excluded from these calculations.

It’s important to understand what counts as an asset. This usually includes things like checking and savings accounts, stocks, and bonds. Certain assets might be excluded, such as your primary home, one vehicle, and some retirement accounts. SNAP rules are detailed, and understanding asset limits can be complex, so check the official SNAP resources for details.

Remember, the goal is to help people who truly need assistance. The asset test is meant to ensure that those with significant financial resources are not receiving SNAP benefits.

Household Size and SNAP Benefits

Your SNAP benefits are calculated based on the size of your household. A household is defined as the people who live together and buy and prepare food together. The amount of SNAP benefits you receive increases as your household size grows. When applying for SNAP, you will need to list everyone who lives with you and shares meals. The state will verify this information as part of the application process.

The benefits are calculated differently for each household.

- The state considers your household size, income, and allowable deductions.

- Your benefit amount is determined by subtracting certain expenses from your income.

- Deductions might include things like childcare costs and medical expenses.

For example, a single person might receive a smaller amount of monthly benefits than a family of four. The exact amount varies and is adjusted based on the cost of food. The USDA publishes the Thrifty Food Plan, which calculates the cost of a basic, nutritious diet. SNAP benefits are generally designed to help people meet the cost of this diet.

Here’s a simplified table showing a very basic example (remember, it varies by state and changes):

| Household Size | Approximate Monthly Benefit (Example) |

|---|---|

| 1 person | $291 |

| 2 people | $535 |

| 3 people | $766 |

This table is just an estimate and can be different based on your state, but it gives you an idea.

SNAP Application Process and Requirements

Applying for SNAP involves several steps. It usually starts with filling out an application form, which you can often find online or at your local social services office. The application asks for information about your income, assets, household size, and other details. Once you submit the application, the SNAP office will review it and determine your eligibility.

Before you apply, gather the necessary documents. This often includes things like:

- Proof of identity (e.g., driver’s license, birth certificate).

- Proof of income (e.g., pay stubs, tax returns).

- Proof of residency (e.g., utility bills, lease agreement).

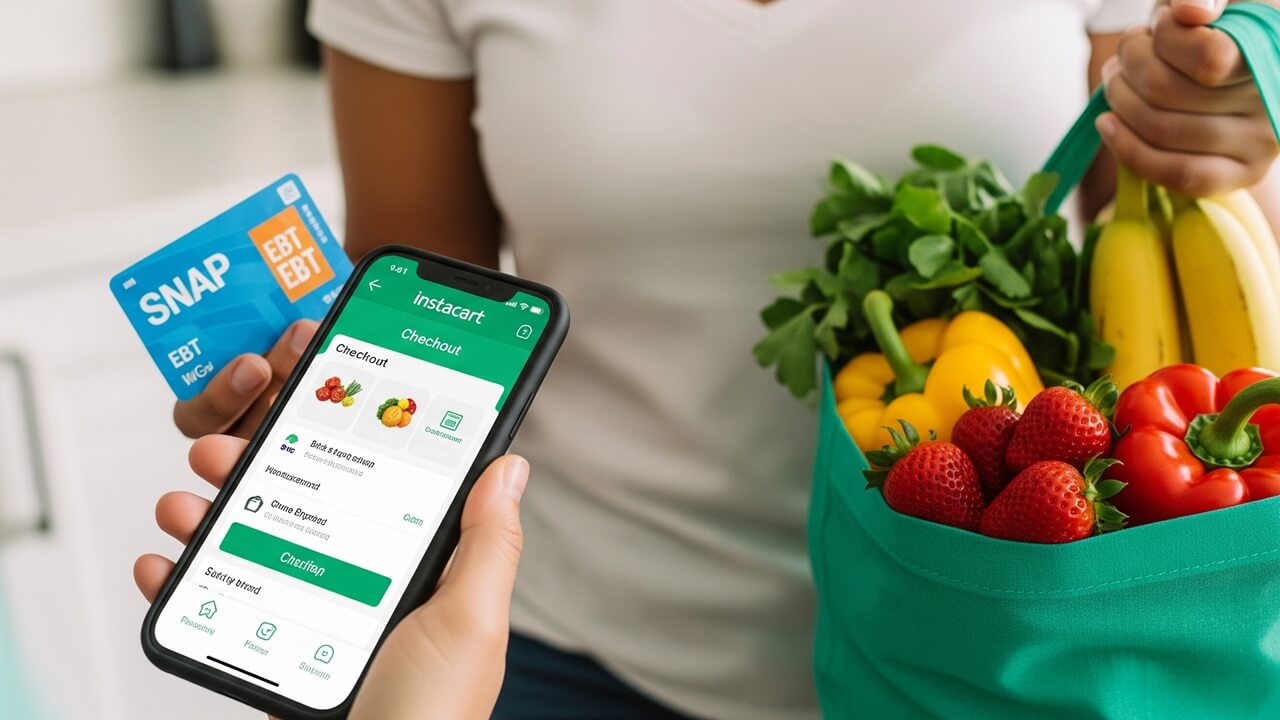

After the application is reviewed, you may need to participate in an interview. This is typically done over the phone or in person and allows the SNAP caseworker to ask clarifying questions and verify the information you provided. If you are approved, you will receive an Electronic Benefit Transfer (EBT) card, which works like a debit card that you can use to purchase groceries. You will need to follow all of the rules, or you may no longer qualify. It is your responsibility to make sure the information is accurate.

The SNAP application process is meant to be straightforward. Be honest and accurate when filling out the application, and be prepared to provide any required documentation.

State Variations in SNAP Programs

While the federal government sets the basic rules for SNAP, states have some flexibility in how they run their programs. This means that the exact rules, eligibility requirements, and benefit amounts can vary from state to state. Some states may have different income limits, asset tests, or application processes. It is crucial to check your specific state’s SNAP guidelines to get accurate information.

Here is what to look at for state variations:

- Income limits: Each state has its own income thresholds to qualify.

- Asset limits: These can vary from state to state.

- Application process: Some states offer online applications, while others require in-person visits.

- Benefit amounts: Your benefit amount can differ depending on your state.

Because of these variations, do not rely on information from other people who live in different states. The best source of information is your state’s SNAP website or local social services agency. They can provide the most up-to-date and accurate information about eligibility requirements and benefit amounts in your area.

When looking for information, type in “SNAP” followed by your state to find the correct site. Do this to ensure you find accurate and detailed information about your state’s specific program.

Conclusion

So, back to our original question: Do you get food stamps automatically if you have Medicaid? The answer is no, not automatically. Having Medicaid doesn’t guarantee that you’ll qualify for SNAP. SNAP eligibility depends on factors like your income, assets, and household size. Both programs are there to help people, but they have different requirements. If you’re wondering if you qualify for SNAP, the best thing to do is to check your state’s specific guidelines and apply. Remember, it’s always a good idea to gather all the necessary documentation and to be truthful and accurate throughout the application process. That’s the best way to ensure you get all the help you’re entitled to!